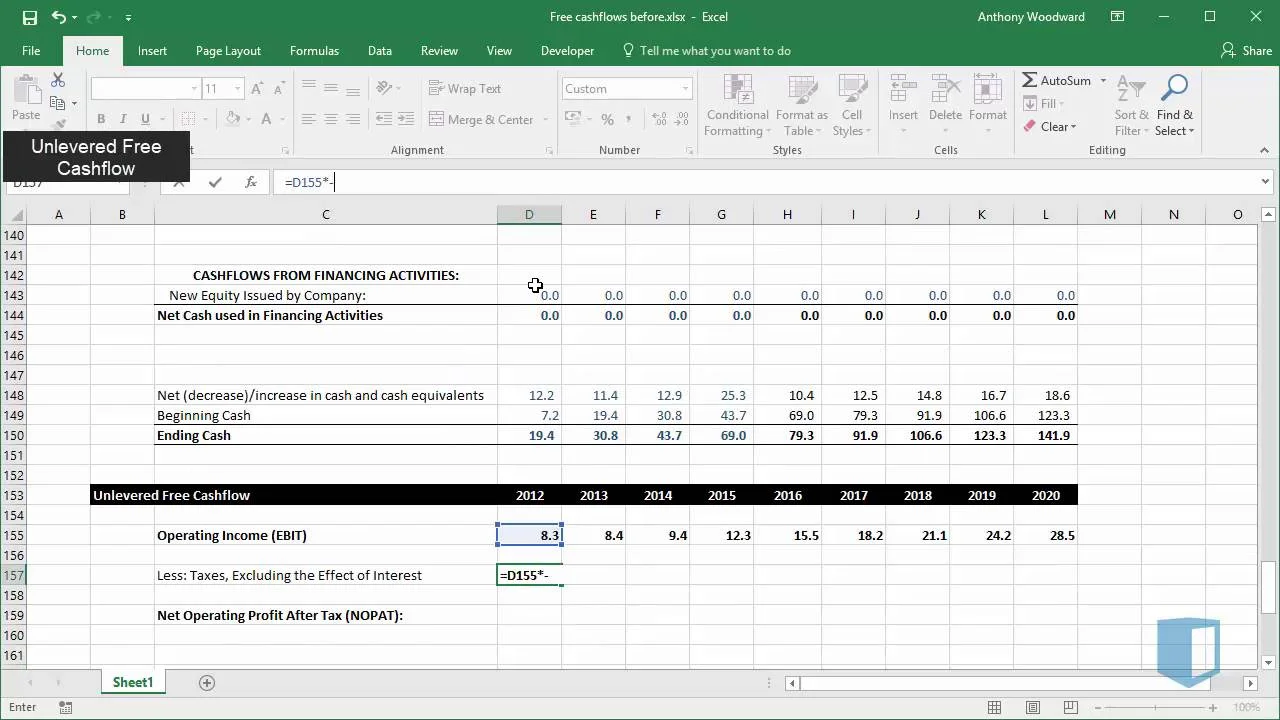

unlevered free cash flow dcf

Related to or available to all. Unlevered Free Cash Flow also known as Free Cash Flow to the Firm or FCFF for short is a theoretical cash flow figure for a business.

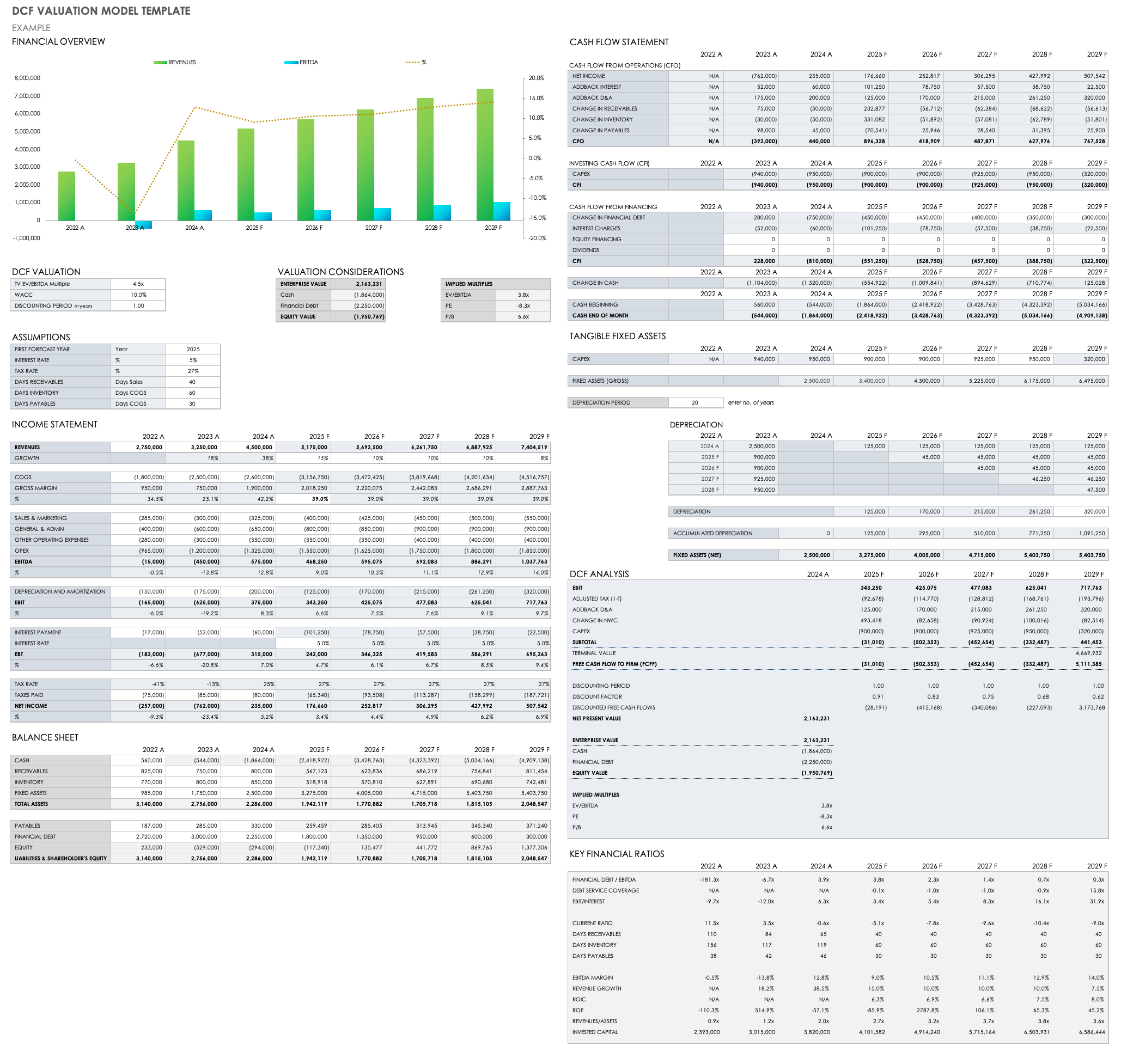

Free Discounted Cash Flow Templates Smartsheet

Leverage is another name for debt and if cash flows are levered that means they are net of.

:max_bytes(150000):strip_icc()/318fd1c560d72df660125152d9538c54-94be4c876080468c9301fe9617b86057.jpg)

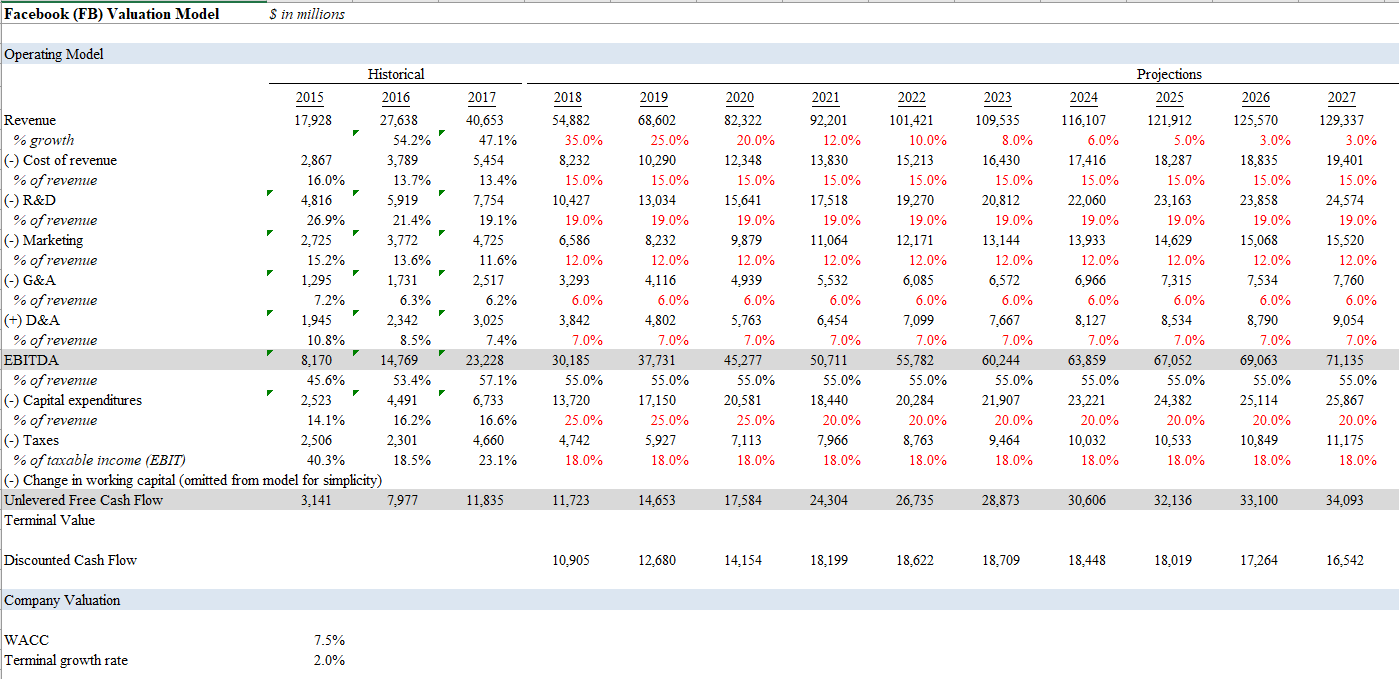

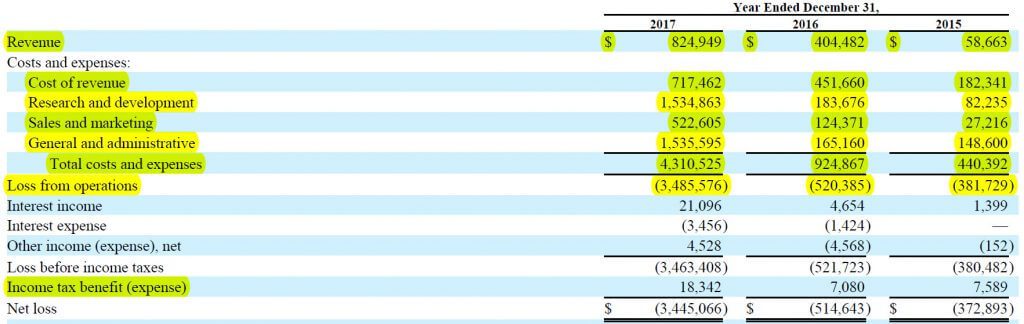

. Since FCFFsFree Cash Flow to Firm are the cash flows that equity and debt providers. Earnings before Interest and Taxes. Just like valuation multiples differ depending on the type of cash flow being used the discount rate in a DCF also differs depending on whether.

Unlevered free cash flow UFCF is the cash flow available to all providers of capital including debt equity and hybrid capital. This metric is most useful when used as part of the discounted cash flow. DCF Tool is a calculator that performs valuation of stocks using the Discounted Cash Flow method.

Unlevered FCF should reflect only items on the financial. Increase in NWC 5 million. Upon entering those inputs into our UFCF formula we arrive at 160 million as our hypothetical companys unlevered free cash flow for the year.

Unlevered free cash flow is the money left from a companys cash flow after making capital expenditures to maintain or improve the businesss assets but before paying any. Unlevered Free Cash Flow also known as UFCF or Free Cash Flow to Firm FCFF is a measure of a companys cash flow that includes only items that are. There are many types of Cash Flow but in a DCF you almost always use something called Unlevered Free Cash Flow.

A business or asset that generates more cash than it invests. If you use a levered free cash flow value with interest expense subtracted you are effectively calculating an equity. Unlevered free cash flow is the gross free cash flow generated by a company.

The present value of the unleveraged cash flow UFCF or enterprise cash flows discounted at WACC less the value of non-common share claims such as debt. Unlevered Free Cash Flow. Unlevered free cash flow UFCF is the cash generated by a company before accounting for financing costs.

The weighted average cost of capital is the appropriate discount rate to apply to an unlevered DCF. See the discussion of. However there are different situations when you prefer one over the other.

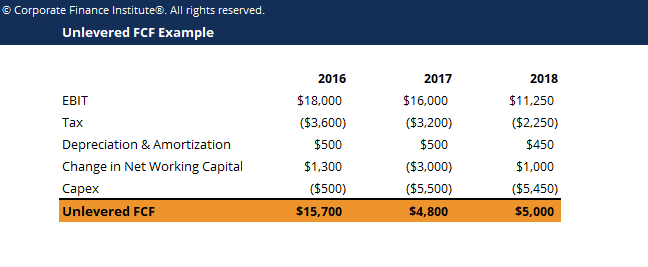

We begin the DCF analaysis by computing unlevered free cash flow. Unlevered free cash flow is used in DCF valuations or debt capacity analysis in highly leveraged transactions to establish the total cash generated by a business for both debt. The difference between levered and unlevered FCF is that levered free cash flow LFCF subtracts debt and interest from total cash whereas unlevered free cash flow UFCF leaves it in such.

The following was originally published on the American Association of Individual Investors AAII. What is Unlevered Free Cash Flow. This article details how to construct an unlevered discounted cash flow DCF.

To demonstrate the formula to calculate unlevered free cash flow involves UFCF EBITDA T CE Increase in NonCash Working Capital Depreciation and Amortization. Free Cash Flow Calculation. Unlevered Free Cash Flow.

Unlevered free cash flow or just FCF is different from levered free cash flow because unlevered free cash flow does not account for debt principal payments. This analysis is provided for informational. Taxes at the Marginal Tax Rate 213.

You can use the levered or unlevered free cash flow to value a company using the DCF method of valuation. It is the cash flow available to all equity. Well free cash flow should correspond with your discount rate.

The present value or. Unlevered Free Cash Flow also known as Free Cash Flow to the Firm or FCFF for short is a theoretical cash flow figure for a business. 212 The Free Cash Flows are calculated using the following formula.

Free Cash Flow Yield Formula And Calculation

Unlevered Free Cash Flow Formulas Calculations And Full Tutorial

Unlevered Fcf Template Download Free Excel Template

Free Cash Flow Calculation And Valuation Youtube

Levered Vs Unlevered Free Cash Flow What S The Difference Analyst Answers

Discounted Cash Flow Analysis Street Of Walls

Free Cash Flow Formula Calculator Excel Template

Unlevered Free Cash Flow Definition Examples Formula

What Is Levered Free Cash Flow Definition Meaning Example

Dcf Model The Complete Guide To Building A Discounted Cash Flow Model

Dcf Model The Complete Guide To Building A Discounted Cash Flow Model

Fcff Vs Fcfe Differences Valuation Multiples Discount Rates

Dcf Model Tutorial With Free Excel Business Valuation Net

Unlevered Free Cash Flow Formulas Calculations And Full Tutorial

Levered Vs Unlevered Free Cash Flow What S The Difference Analyst Answers

Discounted Cash Flow Analysis Street Of Walls

Unlevered Free Cash Flow Ufcf Formula And Calculation

Unlevered Free Cashflow Online Financial Modeling Training Kubicle

Unlevered Free Cash Flow Formulas Calculations And Full Tutorial